310 Area code – get a los angeles, california phone number

Want to establish a local business presence in Los Angeles, CA? Looking to get a 310 area code phone number?...

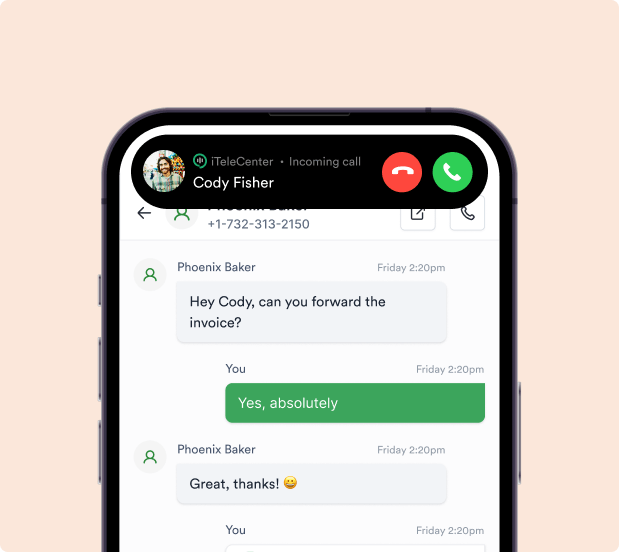

How to make a phone call from a computer (PC or laptop)

We’ve heard the question “How to make a phone call from a computer” quite a few times .. Great. You...

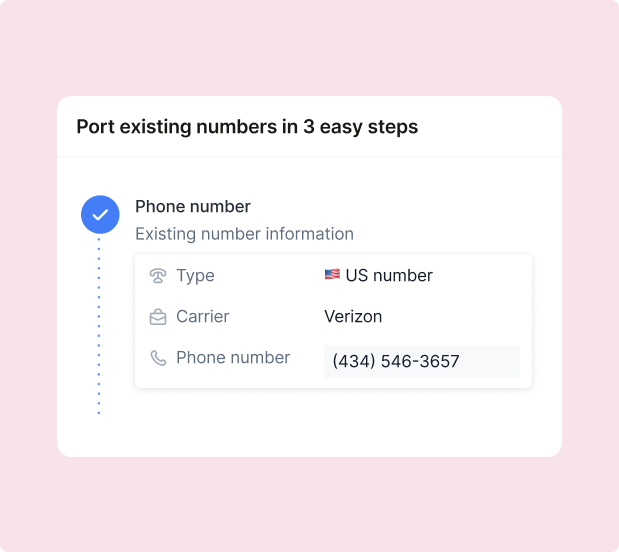

What is phone number porting? how does number porting work?

“What is phone number porting?” Ever wondered if it’s possible to switch your phone service provider without having to change...

UK phone format: your 2024 guide

Looking to grow your business in the UK and connect with customers across different UK regions? Or maybe you want...

How to get a free business phone number in 2024

Want to get a free business phone number for your business but don’t know how to get started? If your...

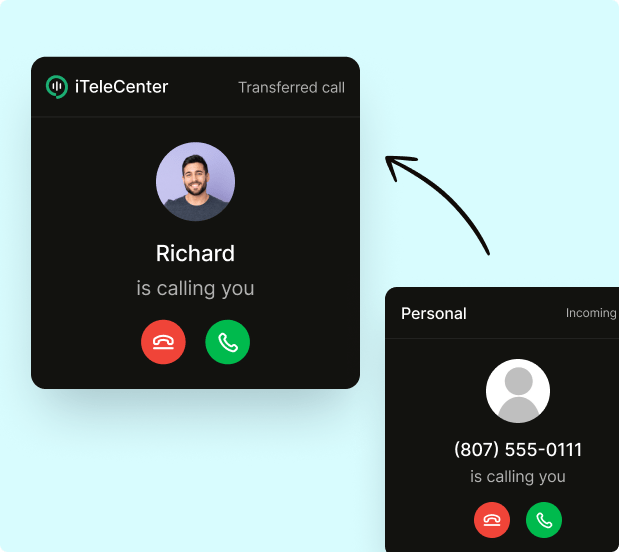

How to add a business line to your cell phone in 4 steps

By now, you might know why using your personal phone number to take business calls is a bad idea. It...

Test drive iTeleCenter for free

Try for free